September 2020

LEADING REMOTE TEAMS

Due to the coronavirus disease (COVID-19) pandemic, many organizations are offering remote work options to more employees than ever before—sometimes out of business necessity. Numerous studies show that remote work had expanded even pre-coronavirus, and continued growth should be expected as employers prepare return-to-work plans.

Expanded use of the remote workplace can offer numerous benefits to employers. These benefits include access to a broadened talent pool, reduced costs and more—though a successful virtual workplace isn’t created without obstacles. Both remote employees and teams face unique challenges—however, leaders can address these barriers with proactive planning.

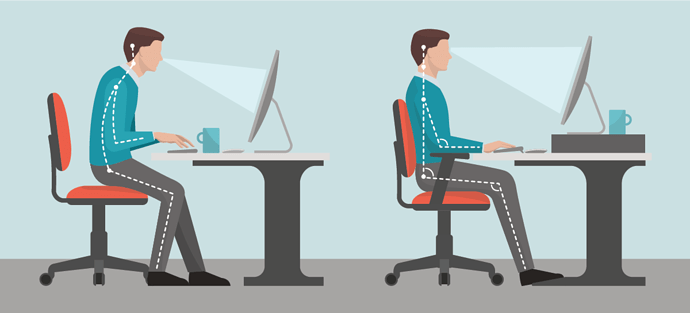

PROPER WORKSPACE ERGONOMICS

One of the primary ways to prevent work-related neck and back injuries is to evaluate your workstation and make sure it is ergonomically correct and promotes good posture. The discomfort and pain from slouching at a desk all day is very common, with many office workers suffering pain at least once a week. If you are working at an ergonomically incorrect workstation or practice poor posture, you can suffer from neck, shoulder, wrist and elbow discomfort.

PREPARING FOR THE PTO BOMB

The COVID-19 pandemic has taken a toll on nearly every facet of the workplace. With everything upended, employers are understandably focused on maintaining their service and product quality. But working hard isn’t the only key to successfully enduring the pandemic—in fact, the opposite may be just as critical.

Paid time off (PTO) is something many employees take for granted. Hundreds of millions of vacation days go unused each year, according to the U.S. Travel Association. Due to a variety of factors, some employees opt not to use time off, and they—and the entire organization—end up suffering for it in the long run.

DOL PUBLISHES FOUR FLSA OPINION LETTERS

On August 31, 2020, the U.S. Department of Labor (DOL) published four new opinion letters. Opinion letters provide the DOL’s official position on how labor and employment standards, in this case the Fair Labor Standards Act (FLSA), apply in specific situations.

PODCAST: PAYROLL TAX DEFERRAL

Check out our latest podcast, “Payroll Tax Deferral (Employer Options and Liability).”

Rob, Scott, and Jason discuss payroll tax deferral (employer options and liability), including: what happens if an employee leaves, what large companies are doing, employer options, and more.

Questions, comments, feedback?

Jason Eisenhut

630.286.7341

jeisenhut@employco.com